HPA Exchange is a vertically integrated, internally managed real estate investment platform that acquires, owns and actively manages single- and multi-tenant medical and life science centric properties throughout the United States. We believe that the demand for healthcare real estate facilities will steadily increase over the next decade as a result of a variety of demographic, economic and regulatory trends.

Market Drivers

An Aging Population

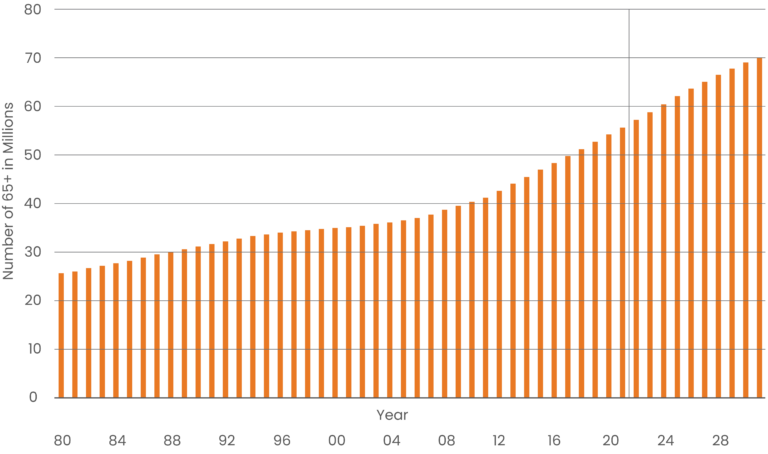

Not only did the number of Americans aged 65 and over grow by nearly 15 million over the past decade, but it is also expected to increase by 47% by 2050, and the age group’s share of the total population is projected to rise an additional 6% to total 23%, according to the U.S. Census Bureau’s 2023 National Population Projections Tables.1

65+ Population in U.S. (Millions)

Chart Source: U.S. Census Bureau, Oxford Economics. As of October 2023.

“An aging population means higher use of healthcare services and a greater need for family and professional caregivers.” – The Office of Disease Prevention and Health Promotion; U.S.

Department of Health and Human Services

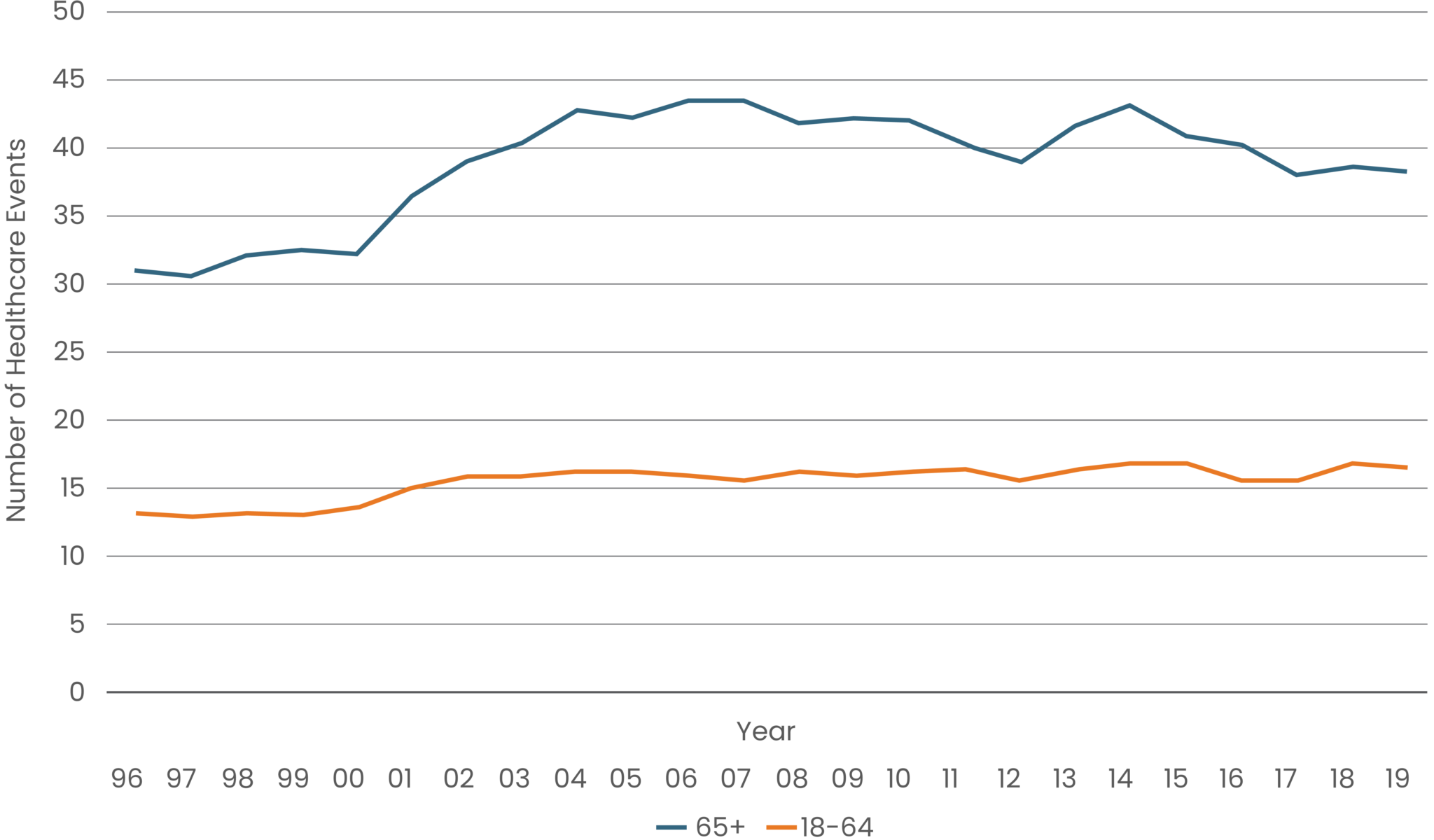

As we age, we typically need more medical treatments. In fact, Americans 65+ drove 36% of healthcare spending in 2021, while composing only 18% of the total population, according to an analysis of the 2021 Medical Expenditure Panel Survey data from the Agency for Healthcare Research and Quality.2

Average Number of Healthcare Events Per Person

Chart Source: Agency for Healthcare Research and Quality Medical Expenditure Panel Survey. Data as of 2019.

Demand for Services

Increase in Spending

Healthcare spending increased by 4.1% in 2022 to $4.4 trillion, totaling more than 17% of the nation’s gross domestic product, according to the Center for Medicare & Medicaid Services.4 The Office of the Actuary also projects that health expenditures are expected to total 19.7% of the nation’s GDP by 2032.5

Barriers to Entry

As an asset class, healthcare real estate has a fundamental barrier to entry due to various state and municipal regulations that keep assets from being overbuilt.

Job Creation

“Regardless of the economic environment, people still need medical care, which makes healthcare real estate relatively stable and resilient.”

– BOMA International, “Top Trends to Watch in Healthcare Real Estate in 2024,” May 2024

Historic Resiliency

During the most recent COVID-19 crisis, vacancy rates and rent collections remained strong at many medical office buildings. For example, according to data firm Revista LLC, medical office landlords reported collection rates in excess of 90% even during the worst of the pandemic.8 CBRE states in “The Future of Medical Office: A Resilient Investment in Healthcare’s Future” that demand for medical office space stayed positive throughout the pandemic with vacancy rates remaining at pre-COVID-19 levels. Because of this, CBRE states, medical offices have the best long-term adjusted return profile compared traditional office, apartment, logistics and retail properties.9

Historically Healthy Returns

Income Return, Medical Office v. Other Property Types

Chart Source: NCREIF. Medical office references the “Healthcare”classification, per guidance from NCREIF that it only includes medical office assets. Sample sizes for

medical office are < 30 prior to 2013. Past performance is not a guarantee of future results.

“In addition to healthy fundamentals, since 2006, the medical office subsector has delivered on average the highest income returns compared with the four major property types.”9

– CBRE, “The Future of Medical Office: A Resilient Investment in Healthcare’s Future,” November 2023

The Rise of Ambulatory Surgery Centers

Sources:

1. U.S. Census Bureau. 2023 National Population Projections Tables: Main Series.

2. JLL. Medical Outpatient Building Perspective. 2024.

3. PRB. Rising Obesity in an Aging America. July 2022.

4. https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet#:~:text=Historical%20NHE%2C%202022%3A,18%20percent%20of%20total%20NHE

5. https://www.cms.gov/newsroom/press-releases/cms-releases-2023-2032-national-health-expenditure-projections

6. Altarum. Health Sector Economic Indicators, Insights from Monthly National Health Employment Data through December 2023. January 2023.

7. https://www.healthleadersmedia.com/human-resources/healthcare-accounts-24-all-new-us-jobs-2023

8. https://revistamed.com/mob-sales-were-okay-in-1q-at-2-5-billion/

9. CBRE. The Future of Medical Office: A Resilient Investment in Healthcare’s Future. November 2023.

10. Sg2.2023 Impact of Change Forecast. June 2023.

11. ASC Data. ASC Industry Overview. August 2024.

This is neither an offer to sell nor a solicitation of an offer to buy securities described herein. An offering is made only by the Confidential Private Placement Memorandum (PPM). This sale and advertising literature must be read in conjunction with the PPM in order to understand fully all of the implications and risks of the offering to which it relates. A copy of the PPM must be madeavailable to you in connection with an offering. Prospective Members should carefully read the PPM and review any additional information they desire prior to making an investment and should be able to bear the complete loss of their investment. Securities offered through American Alternative CapitalSM (AAC), LLC, member FINRA/SIPC. Only available in states AAC is registered. American Alternative Capital and HPA Exchange LLC are not affiliated companies. You can check the background of AAC on FINRA’s BrokerCheck.